Recyclable Paper Wrapper Market Decade of Growth Ahead

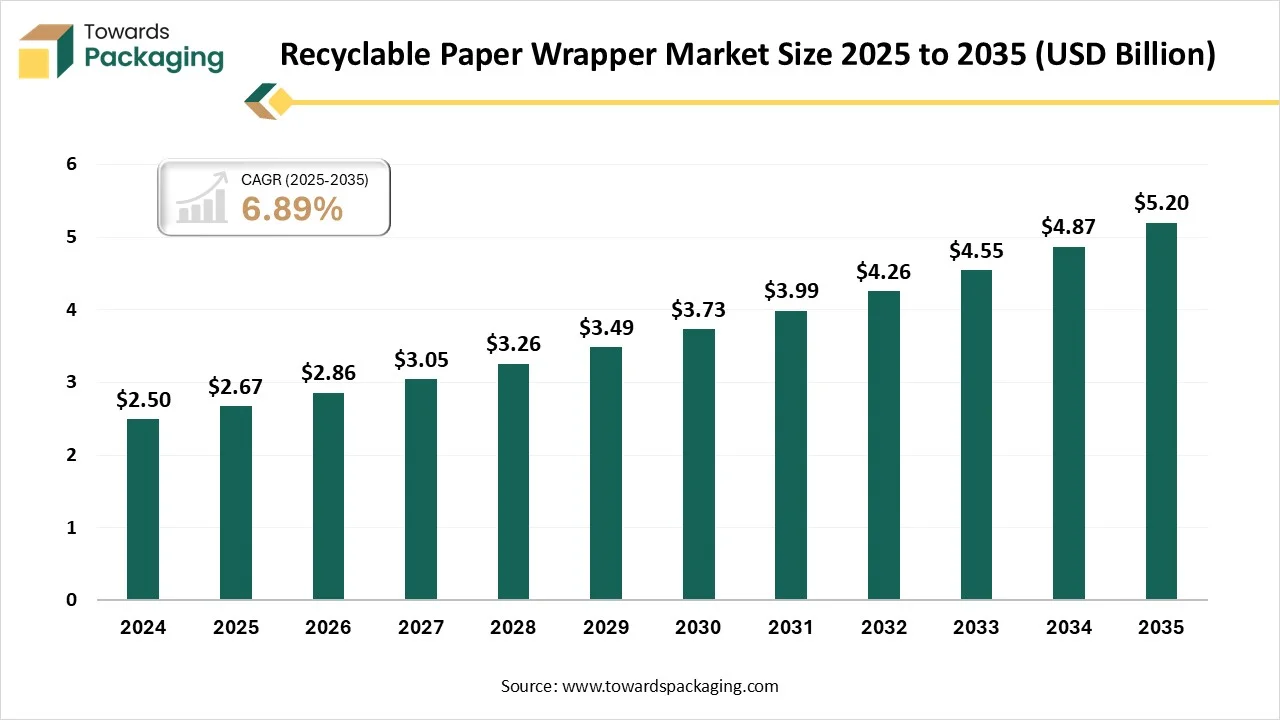

According to Towards Packaging consultants, the global recyclable paper wrapper market is projected to reach approximately USD 5.2 billion by 2035, increasing from USD 2.67 billion in 2025, at a CAGR of 6.89% during the forecast period 2026 to 2035.

Ottawa, Feb. 19, 2026 (GLOBE NEWSWIRE) -- The global recyclable paper wrapper market size stood at USD 2.67 billion in 2025 and is projected to reach USD 5.2 billion by 2035, according to a study published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is meant by Recyclable Paper Wrapper?

A recyclable paper wrapper is a packaging material made from paper that can be collected, processed, and reused to create new paper products, reducing environmental impact. The market growth is driven by rising consumer preference for eco-friendly packaging, increasing environmental regulations, sustainability initiatives by manufacturers, and the growing adoption of alternatives to single-use plastics in the food, beverage, and retail industries. Innovations in biodegradable and compostable paper also support expansion.

Private Industry Investments for Recyclable Paper Wrappers:

- Mondi (€200 Million): The company converted its Duino mill in Italy into a high-capacity facility for recycled containerboard to meet the demand for sustainable paper packaging.

- Stora Enso (€1.1 Billion): This investment converted the Oulu mill in Finland into a modern consumer board production line aimed at replacing plastic packaging in the food and beverage industry.

- Huhtamaki (€20 Million): The firm expanded its manufacturing site in Nules, Spain, to specifically boost the production of renewable and recyclable paper-based packaging for Europe.

- Amcor (Venture Funding): Through its Lift-Off program, Amcor invested in fiber technology startups like PulPac to accelerate the commercialization of dry molded fiber paper packaging.

-

Smurfit Kappa ($19 Million): This project modernized its facility in Cali, Colombia, to increase the output of high-performance, sustainable paper sacks and wrappers for the Latin American market.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5946

What Are the Latest Key Trends in the Recyclable Paper Wrapper Market?

1. Paperization and Plastic Substitution

Brands are increasingly replacing plastic films and multi‑layer laminates with high‑performance, fiber‑based paper alternatives that fit existing recycling systems. Advanced barrier coatings now offer moisture and grease resistance without compromising recyclability, enabling sustainable packaging for snacks and consumer goods while supporting circular economy goals and reducing dependence on non‑recyclable plastics.

2. Mono‑Material and Recyclable‑by‑Design Packaging

The shift toward mono‑material designs, where every component is from the same paper family, simplifies recycling and reduces contamination in recovery streams. This “recyclable‑by‑design” approach improves recycling rates and pulp purity, streamlines waste sorting, and helps brands meet stringent environmental standards while making packaging easier for consumers to recycle correctly.

3. Regulatory‑Driven Recyclability Requirements

Emerging policies like extended producer responsibility (EPR) and comprehensive packaging regulations in markets such as the EU and UK are making recyclability a financial and legal obligation, not just a preference. These mandates push companies to adopt recyclable paper wrappers, increase recycled content use, and redesign packaging to meet lifecycle and sustainability benchmarks.

4. Biodegradable and Compostable Enhancements

Alongside recyclability, biodegradable and compostable paper materials including plant‑based fibers and bio‑coatings are gaining traction. These materials break down naturally without leaving harmful residues, align with consumer environmental values, and help brands differentiate through sustainability while addressing landfill and waste challenges in applications like food and retail packaging.

5. Minimalist and Consumer‑Friendly Design

Minimalist packaging designs that reduce material use and embrace simple aesthetics are becoming mainstream. By eliminating unnecessary layers, shrinking package sizes, and lightweighting designs, brands decrease material costs and carbon emissions, enhance shelf appeal with clean visuals, and appeal to eco‑conscious consumers who value both sustainability and functionality.

What is the Potential Growth Rate of the Recyclable Paper Wrapper Industry?

The recyclable paper wrapper industry is poised for strong growth due to increasing consumer demand for sustainable packaging solutions and heightened regulatory pressure to reduce plastic waste. Expanding adoption across food, beverage, and retail sectors, combined with technological advancements in biodegradable coatings and high-performance paper materials, is driving widespread industry interest. Rising investments in eco-friendly packaging innovations and circular economy initiatives further enhance the market’s potential for rapid and sustained expansion.

More Insights of Towards Packaging:

- North America Stick Packaging Market Size and Segments Outlook (2026–2035)

- Hot Drinks Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Recyclable Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Reusable Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- U.S. Molded Pulp Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Vaccine Storage Packaging Market Size, Trends and Segments (2026–2035)

- Intelligent Packaging Market Size, Trends and Segments (2026–2035)

- Plastic Packaging Market Size and Segments Outlook (2026–2035)

- Lightweight Industrial Corrugated Packaging Market Size and Segments Outlook (2026–2035)

- Sustainable Aerosol Packaging Market Size, Trends and Segments (2026–2035)

- Poly-Woven Packaging Market Size, Trends and Segments (2026–2035)

- Mono-Material Cosmetic Tubes Market Growth, Trends & Forecast (2025-2035)

- U.S. Beer Packaging Market Size and Trend, Segment Outlook (2026–2035)

- Cold Chain Packaging Refrigerants Market Size, Trends and Segments (2026–2035)

- Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- Heavy-Duty Corrugated Bulk Boxes Market Size and Segments Outlook (2026–2035)

- Next-Gen Paper & Fiber-Based Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Flow Wrap Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- India Molded Pulp Packaging Market Size, Trends and Segments (2026–2035)

- Clear Plastic Film Market Size, Volume, Price and Trends (2026 - 2035)

Regional Analysis:

Who is the leader in the Recyclable Paper Wrapper Market?

The Asia‑Pacific region dominates the market due to China and India’s driving demand with massive e‑commerce, food, and FMCG growth, and strong manufacturing bases that accelerate sustainable packaging adoption. Key players are innovating recyclable coatings and high‑barrier paper formats, integrating closed‑loop recycling and lightweight designs to meet strict plastic bans and eco policies, reinforcing APAC leadership in recyclable paper solutions.

China Recyclable Paper Wrapper Market Trends

China leads the Asia-Pacific market because strong government policies like bans on single-use plastics and rules encouraging recyclable materials push brands toward fiber-based solutions. China’s massive e-commerce and express delivery growth fuels demand for recyclable paper mailers and corrugated formats, while domestic manufacturers invest in higher-performance recycled fiber grades and water-based coatings to meet food-safe and sustainability standards. China also emphasizes closed-loop recycling infrastructure and lightweight paper innovations, strengthening the region’s competitive edge.

How is the Opportunistic is the Rise of North America in the Recyclable Paper Wrapper Industry?

The North America region is estimated grow at the highest CAGR in the market due to strong regulatory pressure to reduce plastic waste and increasing adoption of sustainable packaging across food, beverage, and retail sectors. High consumer awareness regarding environmental impact, well-established recycling infrastructure, and rapid expansion of e-commerce further accelerate demand. Additionally, regional manufacturers are investing in recyclable barrier coatings and fiber-based packaging innovations to meet sustainability commitments and retailer requirements.

U.S. Recyclable Paper Wrapper Market Trends

The U.S. dominates the North American market due to its strong packaging industry base, high demand from food, beverage, and e-commerce sectors, and increasing shift away from plastic materials. Growing state-level regulations on single-use plastics and strong retailer sustainability commitments accelerate adoption. Additionally, investments in advanced fiber-based barrier technologies and efficient recycling systems further strengthen the country’s leadership position.

How Big is the Opportunity for Growth of the European region in Industry?

Europe’s recyclable paper wrapper industry presents a strong growth opportunity driven by tightening environmental regulations, rising consumer demand for sustainable packaging, and increasing corporate commitments to circular economy principles. Expanding recycling infrastructure and supportive government policies further bolster adoption. Manufacturers and brand owners are increasingly shifting toward eco-friendly materials to meet sustainability goals, creating significant potential for innovation, investment, and competitive differentiation across the region.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Segment Outlook

Product Type Insights

What made the Corrugated Boxes Segment Dominant in the Recyclable Paper Wrapper Market?

The corrugated boxes segment dominates due to its superior strength, lightweight nature, cost-effectiveness, and versatility across industries. Its excellent protective qualities and ease of recycling align with sustainability goals. Widespread use in e-commerce and logistics, coupled with established manufacturing infrastructure, further reinforces its leading position in the recyclable paper wrapper market.

The folding carton is estimated to be the fastest-growing segment due to increasing demand for attractive, sustainable packaging in consumer goods, cosmetics, and pharmaceuticals. Its lightweight, customizable design enhances brand appeal while reducing environmental impact. Growth is also driven by rising retail and e-commerce activities, and stronger consumer preference for eco-friendly alternatives to plastic, boosting adoption across industries.

Material Type Insights

How the Kraft Paper Dominated the Recyclable Paper Wrapper Market?

The kraft paper segment dominates the market due to its exceptional strength, durability, and tear resistance, making it ideal for heavy-duty packaging. Its high recyclability and eco-friendly image appeal to sustainability-focused consumers and brands. Widespread availability, cost-effectiveness, and compatibility with printing and customization further drive preference across industries seeking robust, sustainable packaging solutions.

The recycled paper/paperboard segment is estimated to be the fastest growing segment due to rising environmental awareness, stricter sustainability regulations, and increased preference for circular packaging. Its lower resource consumption and reduced waste appeal to eco-conscious brands and consumers. Growth is also driven by improved recycling technologies and stronger supply chains supporting recycled material adoption across industries.

End-User Insights

What made the Food and Beverage Packaging Segment Dominant in the Recyclable Paper Wrapper Market?

The food and beverage packaging segment dominates because of high demand for sustainable, safe, and lightweight packaging. Consumer preference for eco-friendly products and strict food safety standards drive the adoption of recyclable paper wrappers. Its versatility for varied food types, strong supply chains, and widespread use in retail and quick-service sectors further reinforce its leading position in the market.

The e-commerce and retail segment is expected to be fastest growing in the market due to booming online sales and increasing demand for sustainable packaging solutions. Recyclable paper wrappers offer lightweight, protective, and eco-friendly options that enhance customer experience and reduce environmental impact. Rising consumer preference for green brands, coupled with retailer commitments to sustainability, accelerates adoption across logistics, fulfillment, and last-mile delivery operations.

Packaging Type Insights

How the Secondary Packaging Dominated the Recyclable Paper Wrapper Market?

The secondary packaging segment dominates because it protects and bundles primary packaged products during storage and transportation, reducing damage and improving logistics efficiency. Its compatibility with recyclable paper materials supports sustainability goals. Widespread use across industries like food & beverage, consumer goods, and electronics, along with cost-effectiveness and easier handling, further strengthens its market leadership.

The flexible paper packaging segment is estimated to be the fastest-growing segment in the market because it offers lightweight, space-efficient, and customizable solutions that reduce material use and shipping costs. Its adaptability for various products, from snacks to personal care, meets rising consumer demand for convenience and sustainability. Enhanced printability, improved barrier properties, and increasing brand focus on eco-friendly packaging further accelerate its adoption across industries.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Recyclable Paper Wrapper Industry

- In January 2026, Amcor, a global packaging leader, partnered with French organic brand Alter Eco to launch a lighter, paper-based, recyclable wrapper for 200 g chocolate bars. The new packaging combines sustainability with moisture and grease protection, reducing material weight and boosting recyclability under CEPI/4evergreen standards.

- In December 2025, Bel Group initiated the commercial transition of Mini Babybel cheese to recyclable paper-based wrappers, beginning in the UK market with plans for expansion across Europe and North America through 2026. The redesigned packaging maintains product safety and shelf life while significantly reducing reliance on traditional wax and plastic materials.

-

In September 2025, Seaman Paper introduced a new heat-sealable, curbside-recyclable paper packaging solution designed as a direct alternative to single-use plastics. Engineered for compatibility with existing converting and filling equipment, the solution provides strong seal integrity and barrier performance.

Top Companies in the Global Recyclable Paper Wrapper Market & Their Offerings:

Tier 1:

- International Paper Company: Their Lift Up product is a 100% curbside recyclable paper band and handle system that secures beverage bottles without plastic.

- WestRock Company: They offer high-strength stretch kraft paper designed for pallet wrapping and industrial protection that is fully recyclable.

- Smurfit Kappa Group: Part of their Better Planet Packaging initiative, they provide recyclable paper-based shrink wrap alternatives for beverage multipacks and retail displays.

- Mondi Group: They produce the FunctionalBarrier Paper range, which provides high-barrier food protection while remaining fully recyclable in existing paper streams.

- DS Smith Plc: Their Alterplas range is a plastic-free, fiber-based solution designed to replace materials like polystyrene and plastic films in protective wrappers.

- Stora Enso Oyj: They offer LumiWrap, an uncoated, recyclable wrapping paper designed specifically for the food industry to handle dry, moist, and fatty products.

- Oji Holdings Corporation: They produce the SILBIO series, a paper-based barrier material that replaces plastic films while maintaining moisture and oxygen resistance.

- Packaging Corporation of America: They have developed specialized recyclable moisture-resistant coatings for corrugated packaging that replace traditional, non-recyclable wax wrappers.

Tier 2:

- Georgia-Pacific LLC

- Nine Dragons Paper Holdings Limited

- Sappi Limited

- UPM-Kymmene Corporation

- Cascades Inc.

- Amcor plc

- Sonoco Products Company

- EcoEnclose

- Paper Mart

- Pratt Industries, Inc.

- Seaman Paper Company

- Saica Group

Segment Covered in the Report

By Product Type

- Corrugated Boxes

- Single-wall corrugated boxes

- Double-wall corrugated boxes

- Triple-wall corrugated boxes

- Folding Cartons

- Straight tuck folding cartons

- Reverse tuck folding cartons

- Auto-lock folding cartons

- Paper Bags

- Brown paper bags

- White paper bags

- Custom printed paper bags

- Kraft paper bags

- Wrapping Paper

- Kraft wrapping paper

- Decorative wrapping paper

- Plain wrapping paper

- Protective Paper Wraps

- Single-layer protective wraps

- Multi-layer protective wraps

- Custom-sized wraps for fragile items

- Molded Pulp Packaging

- Molded fiber trays

- Molded pulp containers

- Molded pulp clamshell packaging

By Material Type

- Kraft Paper

- Virgin kraft paper

- Recycled kraft paper

- Recycled Paper / Recycled Paperboard

- Post-consumer recycled paper

- Post-industrial recycled paper

- Coated Paper

- Gloss-coated paper

- Matte-coated paper

- Clay-coated paper

- Specialty & Treated Paper

- Water-resistant paper

- Oil-resistant paper

- Waxed paper

- Printed & embossed specialty paper

By End-Use

- Food & Beverage Packaging

- E-commerce & Retail

- Logistics & Shipping

- Consumer Goods

- Healthcare & Pharmaceuticals

- Industrial Goods

By Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

- Flexible Paper Packaging

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5946

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

Polyethylene Films Market Size, Trends and Volume (2026-2035)

Thin Wall Packaging Market Size and Segments Outlook (2026–2035)

Dunnage Packaging Market Size, Trends and Segments (2026–2035)

Liquid Packaging Market Size and Segments Outlook (2026–2035)

Food Packaging Market Size, Trends and Segments (2026–2035)

U.S. Seed Packaging Market Size and Segments Outlook (2026–2035)

Europe Pharmaceutical Glass Packaging Market Size, Trends and Segments (2026–2035)

Uncoated Paperboard For Luxury Packaging Market Size and Segments Outlook (2026–2035)

Consumer Packaged Goods (CPG) Market Size, Trends and Competitive Landscape (2026–2035)

Automotive Parts Packaging Market Size, Trends and Competitive Landscape (2026–2035)

North America Yogurt, Cheese & Meat FFS Packaging Market Size, Trends and Segments (2026–2035)

U.S. Black Rigid Plastic Packaging Market Size, Trends and Segments (2026–2035)

Refillable Packaging Market Size, Trends and Regional Analysis (2026–2035)

Dairy Product Packaging Market Size and Segments Outlook (2026–2035)

Middle East Seafood Packaging Market Size, Trends and Competitive Landscape (2026–2035)

Middle East Packaging Machinery Market Size, Trends and Segments (2026–2035)

Biofoam Packaging Market Size and Segments Outlook (2026–2035)

Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44; Request Research Report Built Around Your Goals: sales@towardspackaging.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.